What is ESG?

ESG refers to a set of Environmental, Social and Governance standards that investors and stakeholders use to evaluate and select investments. Over the last decade, ESG has become a top priority topic in boardrooms, C-suite executives have been seeking an effective way to embed ESG factors into their decision-making process. As Hong Kong is committed to addressing ESG issues to contribute towards global sustainability goals, and taking action to achieve carbon neutrality by 2050, ESG disclosure requirements will be increased and made mandatory in the future. It means that ESG will no longer be a nice-to-have but a must-have for companies of all types and sizes in the upcoming years.

Mandatory ESG disclosures are expected to come into effect from 2024 in Hong Kong

The Stock of Exchange of Hong Kong Limited (HKEX) published a consultation paper on proposals to mandate all listed companies in Hong Kong to make climate-related disclosures in their ESG reports, and introduce new climate-related disclosure aligned with the International Sustainability Standards Board (ISSB) Climate Standard. The new disclosure requirements, which if adopted as proposed, will come into effect on 1 January 2024, with a two-year transition period. Commencing on 1 January 2026, all ESG reports released by listed companies must fully comply with the new ESG disclosure requirements.

A summary of the new climate-related disclosure requirements are as follows:

- Governance

Disclose the issuer’s governance process, controls and procedures used to monitor and manage climate-related risks and opportunities.

- Strategy

Disclose the issuer’s strategies on the following aspects:

- Disclose material climate-related risks and opportunities faced by the issuer, and their impact on the issuer’s business operations, business model and strategy.

- Disclose issuer’s response and plans to climate-related risks and opportunities identified, including any changes to its business model and strategy, adaptation and mitigation efforts, and climate-related targets set for such plans.

- Disclose resilience of the issuer’s strategy (including its business model) and operations to climate-related changes, developments or uncertainties, which shall be assessed using a method of climate-related scenario analysis that is commensurate with the issuer’s circumstances.

- Disclose current (quantitative where material) and anticipated (qualitative) financial effects of climate-related risks, and where applicable, opportunities on the issuer’s financial position, financial performance and cash flows.

- Risk management

Disclose the issuer’s process to identify, assess and manage climate-related risks and opportunities.

- Metrics and target

- Greenhouse gas emissions: Disclose scope 1, scope 2 and scope 3 emissions.

- Cross-industry metrics: Disclose the amount and percentage of assets or business activities (i) vulnerable to transition/physical risks or (ii) aligned with climate-related opportunities, and the amount of capital expenditure deployed towards climate-related risks and opportunities

- Internal carbon price: For issuers who maintain an internal carbon price, disclose the internal carbon price and such that was applied in the issuer’s decision-making

- Remuneration: Disclose how climate-related considerations are factored into executive remuneration policy.

Source: HKEX

How to choose the right ESG reporting framework?

To help companies of all types and sizes comply with ESG obligations, various organizations have developed ESG reporting standards. Here are four leading and widely recognized ESG reporting standards and frameworks:

1. GRI Standards

The Global Reporting Initiative (GRI) standards are the most widely used ESG reporting framework and endorsed by United Nations Sustainable Development Goals (SDGs). The GRI standards are applicable to companies of all sizes and across all industries including governments, and divided into three sections: universal standards, sector standards and topic-specific standards. They can reflect the organization’s economic, environmental and social impacts.

2. SASB Standards

The Sustainability Accounting Standards Board (SASB) standards are being applied by more than 72% of the S&P Global 1200 companies*. They are a sector-based, industry specific primarily standards to help publicly traded companies determine the financial materiality of sustainability-related information for disclosure. The SASB standards are broken down by industry, 77 identified industries across 11 different sectors are included.

3. CDP Framework

The Carbon Disclosure Project (CDP) is a voluntary reporting framework that organizations use to disclose environmental information. It offers three questionnaires including climate change, water security and forests which include different methodologies respectively. Both investors and organizations can use the CDP framework to evaluate sustainability performance and drive actions on environmental issues.

4. TCFD Framework

The Task Force on Climate-related Financial Disclosures (TCFD) is a voluntary disclosure guideline designed to help organizations stay compliant with current mainstream financial reporting requirements. Hong Kong’s new ESG disclosures will be aligned with the ISSB Climate Standard that builds on the principles of the TCFD recommendations.

* ”Consultation to enhance the International Applicability of the SASB Standards now open”, IFRS

Why is materiality assessment important to your ESG reporting?

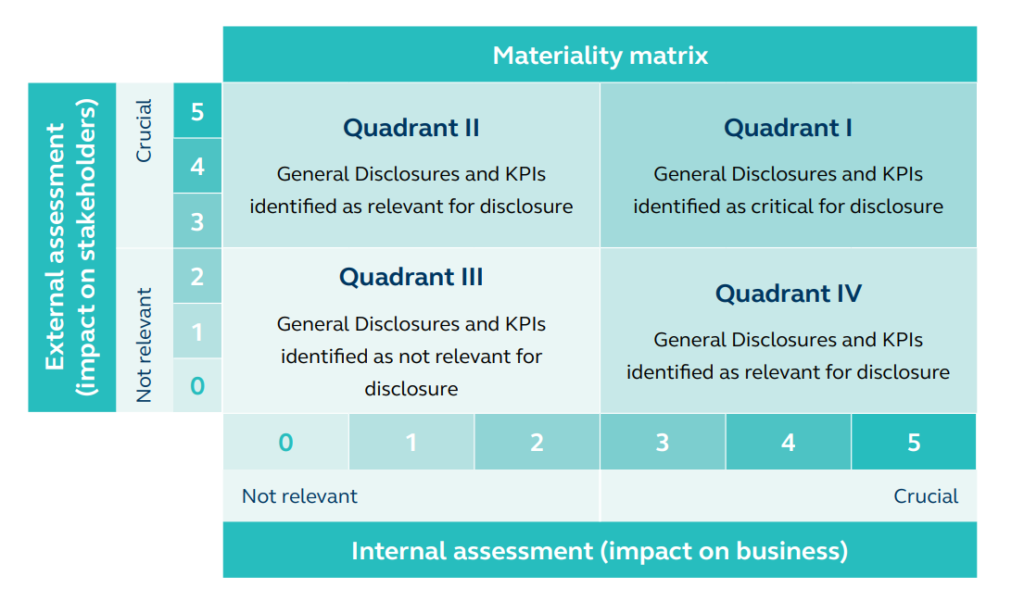

Materiality is one of the keystone Reporting Principles for preparing a quality ESG report. It is defined as the threshold at which ESG issues are determined by the board to be sufficiently important to investors and other stakeholders that they should be disclosed. International standards / guidance (such as the GRI Standards and the TCFD Recommendations) and

the Guide address many environmental and social issues, but not all of these issues are relevant to all companies. Depending on the industry, geographical location(s) of its operations and other factors.

Here is the basic layout of a materiality assessment:

Photo source: HKEX

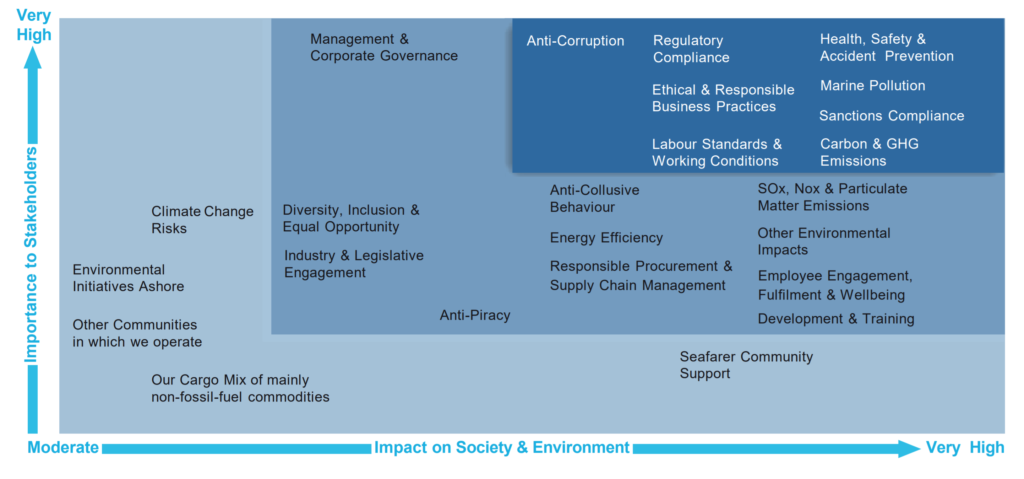

An example of a Materiality Assessment

Photo Source: HKEX

How can a company navigate its ESG journey?

When it comes to a sustainability agenda, many companies have established one but failed to act on it. Accelerating a company’s ESG agenda is not a one-off activity, it requires continuous efforts to manage stakeholder communications, and view and monitor sustainability initiatives. In the ever-changing landscape of ESG, it is also important to keep an eye on the latest trends as ESG regulations and disclosure requirements are rapidly evolving. Want to drive your company’s sustainability agenda forward? Click here to read about the practical tips from us: 4 Practical Ways to Drive Your Sustainability Agenda

How do leaders and professionals in the HR and Property Management prepare for mandatory ESG reporting?

Both HR leaders and real estate professionals play an important role in ESG.

Real estate companies and property management companies are playing a vital role in the “Environmental” pillar of ESG. According to “Hong Kong’s Climate Action Plan 2030+”, buildings contribute to 60% of total greenhouse gas emissions and 90% of electricity consumption in Hong Kong, therefore, the real estate industry addressing climate change will make significant contributions to achieving net zero carbon emissions by 2050. Regardless of new constructions, rental properties or owned spaces, embedding ESG throughout the whole life cycle of these buildings is the top priority. ESG initiatives not only represent environmental benefits, but also business opportunities, risk mitigation and cost savings for the real estate industry.

HR leaders are responsible for the “Social” pillar of their company’s ESG initiatives. The “Social” pillar is for assessing a company’s impact on its workforce and the wider communities, including issues of diversity, equity and inclusion (DEI), employee rights, talent attraction and retention, charitable activities, community work, and so on. To perform good in the HR-related ESG aspect, HR leaders need to show stakeholders and investors the story and impact of their company, such as how the company mitigates its negative impact on the environment, make a positive contribution to the society, or create a robust and inclusive culture that attract and retain a diverse workforce that will impact its long-term success.

To enhance ESG’s transparency and compliance, data management serves as a fundamental prerequisite for ESG reporting. Keeping track of ESG data and presenting them well in ESG reports are crucial for leaders in the HR sector and the real estate sector. GaiaPM’s Property and Lease Management Software (PMS) and aCube Solutions’ Human Resources Management Software (HRMS) help your company collect, harmonize and analyze ESG data to achieve efficient and transparent reporting on your ESG performance. Contact us to learn more today!

GaiaPM, a member of the FlexSystem Group, provides international lease and property management software designed to help you drive performance up and costs down. As a global solutions provider in over 38 countries GaiaPM, together with its proven solutions for multi-currency financials, human resources, and operations, is a business software vendor to 1 in 10 Forbes Global 2000 (May 2020), and 1 in 5 Global Fortune 500 (August 2020), operating at the intersection of new digital process and payment technologies, whether on-premise, hybrid or cloud, to provide you with iterative opportunities for value creation.